MySaver is a fast and easy way for first home buyers to be matched with an expert adviser. An adviser can help you choose the right KiwiSaver investment mix for you.

Saving for a deposit may seem daunting, but with the right commitment and support you can achieve it!

First home buyers:

For such a key life decision getting the right advice matters. MySaver matches you with an expert adviser that can explore the correct KiwiSaver investment mix for you.

You can gain peace of mind knowing your retirement savings are invested in the right strategy for you.

Retirement Savers:

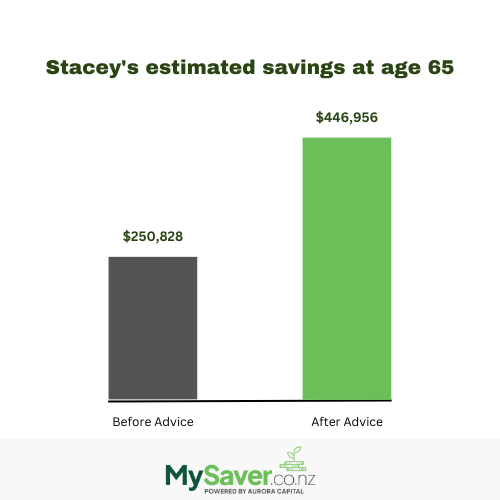

Take a look at Stacey.

She's 25. She's an employee and earns $50,000 a year. Her KiwiSaver balance is $20,000.

Before getting expert advice

After getting expert advice

Calculations sourced from www.sorted.org.nz

We make it easy for you to decide what's right for you.

You can change how much you contribute due to changes in your life such as:

Now you can focus on getting the most out out of your savings, with expert advice!

Do you know what fund you're in? What time frame is your fund type best suited for? Is this the right fund type for you?

A financial adviser can review your KiwiSaver strategy and help you: