Let’s get started! Fill in the quick form and we’ll get an adviser in touch within 2 business days. Easy!

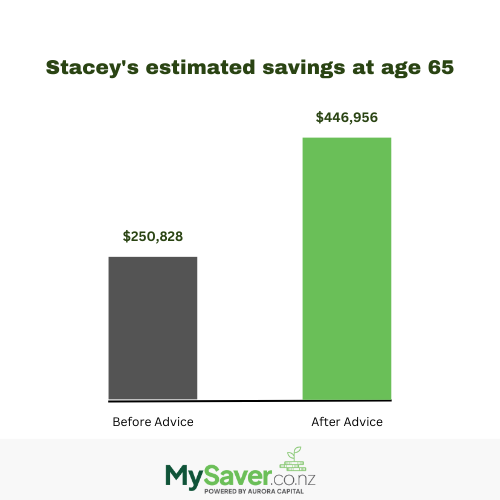

Stacey's 25 and is an employee and earns $50,000 a year. Her KiwiSaver balance is $20,000.

Before getting expert advice

• She's invested in: Balanced fund type

• She contributes: 3% of her salary

• Expected savings at age 65: $250,828*

After getting expert advice

• She's invested in: Growth fund type

• She contributes: 6% of her salary

• Expected savings at age 65: $446,956*

*Calculations sourced from www.sorted.org.nz

Your savings journey is all about you: where you are right now...and where you are trying to get to.

That’s where advice can help.

Having the right savings plan in place can make a huge difference to how much money you have for buying your first home or being able to retire comfortably.

We match you with an adviser who will understand and deliver you the information and options you need to achieve your goals.

MySaver is a fast and easy way for first home buyers to be matched with an expert adviser. An adviser can help you choose the right KiwiSaver investment mix for you.

For such a key life decision getting the right advice matters. MySaver matches you with an expert adviser that can explore the correct KiwiSaver investment mix for you.

You can gain peace of mind knowing your retirement savings are invested in the right strategy for you.